BLOG POST

by Felicity Blaze

Noodleman

Los Angeles, CA

12.20.13

MONEY AND INFLATION

* Special thanks to "Google Images", "wikipedia.com", "CNBC",

Patrick Barron and "BloombergBussinessweek"

How Much Longer Will the Dollar Be

the World’s Reserve Currency?

October 14, 2013

In an

English-language editorial, China’s Xinhua news agency said the world should

consider a new reserve currency “that is to be created to replace the dominant

U.S. dollar, so that the international community could permanently stay away

from the spillover of the intensifying domestic political turmoil in the United

States."

China

is the largest foreign holder of U.S. government debt, with about $1.3 trillion

of Treasury bonds in its portfolio. China is also a huge buyer of gold. Some

analysts believe China’s government is building gold reserves to create its own

gold-backed currency.

Patrick Barron is president of PMG

Consulting, LLC and has been a consultant to the banking...

http://news.heartland.org/newspaper-article/2013/10/14/how-much-longer-will-dollar-be-worlds-reserve-currency

Last week we took a look at the process involved in making

our US currency. We briefly wrote about

how money is able to affect the economy and our monetary policy. We also mentioned how counterfeiting by foreign

governments could destroy the value of our currency and harm the overall

economy. This is where we would like to

begin this week’s article on the "Noodleman Group"!

The one single person responsible for maintaining the health

of our US economy is the Chairman of The Federal Reserve. You could say he is the US economic

Tsar. He is the man who adjust all the

knobs and levers (So to speak)

economists employ to maintain the overall health of the economy. The Chairman

of the Fed., as they are sometimes called or just the Fed. for short, are

highly educated and skilled economists who know how to keep the economy running

like a well-oiled machine. If we could

compare the economy to the operation of an automobile, the Fed. is the man who

knows when to apply the gas or put on the brakes. He

keeps the economy running in the direction which is best for the country. The Fed. chairman also knows where repairs

need to be made when the economy is breaking down.

|

Allen Greenspan

1987-2006

(Photo:wikipedia.com)

|

The Chairman of The Federal Reserve is appointed by the

President of the US and is responsible for running the economy as the President

wishes. Our most recent Chairman, Allen

Greenspan, was appointed by President Reagan and served at the Federal Reserve

from 1987 until 2006. Mr. Greenspan was

reappointed by Presidents G.H.W. Bush, Clinton and G.W. Bush which speaks very

highly of his work at the Fed. Greenspan

was skilled at navigating the US economy through both difficult and prosperous

periods until his retirement from Washington DC in 2006.

Mr. Greenspan will be our model for this discussion about

the Fed since he has a record for running the economy successfully over a

period of many years. The Chairman of

The Federal Reserve is the man who calls for more US currency to be printed or

in some cases, to be removed from circulation so the Dollar is a strong and

credible monetary system. For example;

not enough dollars is circulation and money is tight choking off economic

growth. Too many dollars however, and

money begins to become weak and creates inflation, a condition which can become

very dangerous and produce uncontrollable decay for money value if left

unchecked.

Greenspan's tenure at the Fed in many ways was highly successful guiding the country and the Dollar through recessions and prosperous and this is exactly what the Chairman's job is. He must keep his eye on our Dollars and make sure they are a credible world currency.

|

Ben Bernanke

2006 -

(Photo:wikipedia.com)

|

Mr. Greenspan's successor at the Fed. is Ben Bernanke. Appointed by President Bush and now serving under President Obama. During Bernanke's time in office, President Obama has dispersed the "Tarp" moneys authorized by the Bush administration for the purpose of saving the economy after the collapse of the housing bubble which not only threatened the US economy but also the economies of many nations around the world. This also kept many huge US corporations from declaring bankruptcy as a result of the collapse in home prices.

Inflation is always a term we have heard in the news. We are able to see its effects on our wages

and in our home values. Inflation has

been a main component of our US economy going back to at least the days of the Civil

War. To gain a better understanding of

inflation we want to turn to Wikipedia.com:

Inflation - Related definitions

The term "inflation" originally referred to increases in

the amount of money in circulation, and some economists still use the word in

this way. However, most economists today use the term "inflation" to

refer to a rise in the price level. An increase in the money supply may be

called monetary inflation, to distinguish it from rising prices, which may also for clarity

be called 'price inflation'. Economists generally agree that in the

long run, inflation is caused by increases in the money supply.

Other economic concepts related to inflation include: deflation – a fall in the general price level; disinflation – a decrease in the rate of

inflation; hyperinflation – an out-of-control inflationary spiral; stagflation – a combination of inflation, slow

economic growth and high unemployment; and reflation – an attempt to raise the general level of

prices to counteract deflationary pressures.

Since there are many possible measures of the price level, there

are many possible measures of price inflation. Most frequently, the term

"inflation" refers to a rise in a broad price index representing the

overall price level for goods and services in the economy. The Consumer Price Index (CPI), the Personal Consumption

Expenditures Price Index (PCEPI)

and the GDP deflator are some examples of broad price indices.

However,

"inflation" may also be used to describe a rising price level within

a narrower set of assets, goods or services within the economy, such as commodities (including food, fuel, metals), tangible

assets (such as real

estate), financial assets (such as stocks, bonds), services (such as entertainment and

health care), or labor.

The Reuters-CRB Index (CCI), the Producer Price Index, and Employment Cost Index (ECI) are examples of narrow price indices used to measure

price inflation in particular sectors of the economy. Core

inflation is a measure of inflation

for a subset of consumer prices that excludes food and energy prices, which

rise and fall more than other prices in the short term. The Federal Reserve Board pays particular attention to the core inflation rate to get

a better estimate of long-term future inflation trends overall.

"wikipedia.com"

Fed

will get its inflation; here’s who will pay

CNBC

What’s good for central banks isn’t

always good for the individuals they are supposed to serve, a lesson likely to

come into view even more clearly in the days ahead.

Higher inflation that’s to come

will mean still-tough times for savers and retirees, whose money has generated

little return since the Fed took over the post-crisis economy.

http://thefinancialphysician.com/2013/09/fed-will-get-its-inflation-heres-who-will-pay/

|

Alexander Hamilton

1789 - 1795

|

United States Economic policy has always been a “high wire flying

act” even from the countries beginning days as the founding fathers who wrote

the Constitution sought to finance their dreams and establish the United States

as a nation. Alexander Hamilton, the

first Secretary of the Treasury, and many of today’s economic policies are

still based upon Hamilton’s founding practices.

What Hamilton understood and was able to do so well, was finance US debt

by using the debt itself as an asset to trade upon. Sounds crazy right, but it worked and is

still being used today. The real

strength of the US economy is that it’s here, it’s strong, it’s growing and it

has a good forecast for the future. The

United States is able to do many things with money which no other nation has

ever been able to do and will probably never be duplicated!

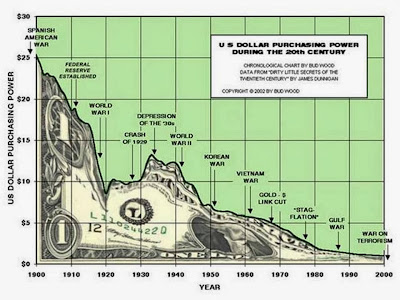

So how is all of this related to our economy today? Again we have to return to the INFLATION

feature of our economy. Using WWII as a beginning

point for the last inflationary run, the economy grew and expanded until the

collapse of the housing bubble of 20007-2012.

During this period of history inflation grew at a steady and moderate

rate increasing wages and home values.

Goods and the purchasing power of the dollar kept pace with inflation

allowing people to feel a sense of satisfaction because they could see more

money coming into their pockets.

How Much Longer Will the Dollar Be the World’s Reserve

Currency?

October 14, 2013

http://news.heartland.org/newspaper-article/2013/10/14/how-much-longer-will-dollar-be-worlds-reserve-currency

Patrick Barron

Patrick Barron is president of PMG Consulting,

LLC and has been a consultant to the banking... (read full bio)

Editor’s note: China’s

official press agency in October called for ending the U.S. dollar as the

world's reserve currency.

In an English-language

editorial, China’s Xinhua news agency said the world should consider a new

reserve currency “that is to be created to replace the dominant U.S. dollar, so

that the international community could permanently stay away from the spillover

of the intensifying domestic political turmoil in the United States."

China is the largest

foreign holder of U.S. government debt, with about $1.3 trillion of Treasury

bonds in its portfolio. China is also a huge buyer of gold. Some analysts

believe China’s government is building gold reserves to create its own

gold-backed currency.

This news makes the

following commentary, posted Oct. 12 at the Mises.org Web site, especially

timely.

We use the term “reserve

currency” when referring to the common use of the dollar by other countries

when settling their international trade accounts. For example, if Canada buys

goods from China, it may pay China in U.S. dollars rather than Canadian

dollars, and vice versa. However, the foundation from which the term originated

no longer exists, and today the dollar is called a “reserve currency” simply

because foreign countries hold it in great quantity to facilitate trade.

Banker Expresses Fears of Current

Fed Policy

May 1, 2013

The first reserve currency

was the British Pound Sterling. Because the pound was “good as gold,” many

countries found it more convenient to hold pounds rather than gold itself

during the age of the gold standard. The world’s great trading nations could

hold pounds rather than gold, with the confidence that the Bank of England

would hand over the gold at a fixed exchange rate upon presentment.

Toward the end of World

War II the U.S. dollar was given this status by international treaty following

the Bretton Woods Agreement, with the promise that the Fed would not inflate

the dollar and stood ready to exchange dollars for gold at $35 per ounce.

U.S. Called to Account

Unfortunately, the Fed did

not maintain that commitment. It was called to account in the late 1960s, and

to his everlasting shame, President Richard Nixon took the United States “off

the gold standard” in September 1971. Nevertheless, the dollar was still held

by the great trading nations, because there was no other currency that could

match the dollar, despite the fact that it was “delinked” from gold.

Two characteristics make a

currency useful in international trade: One, it is issued by a large trading

nation; and, two, it holds its value vis-à-vis other commodities over time.

Although the dollar was

being inflated by the Fed, thus losing its value vis-à-vis other commodities

over time, there was no real competition. The German Deutsche mark held its

value better, but German trade was a fraction of U.S. trade, meaning holders of

marks would find less to buy in Germany than holders of dollars would find in

the United States. In addition, the United States was seen as the military

protector of all the Western nations against the communist countries for much

of the postwar period.

Other Monies Being Used

Today we are seeing the

beginnings of a change. The Fed has been inflating the dollar massively,

causing many of the world’s great trading nations to use other monies upon

occasion.

I have it on good

authority, for example, that DuPont settles many of its international accounts

in Chinese yuan and European euros. There may be other currencies that are in

demand for trade settlement by other international companies as well. In spite

of all this, one factor that has helped the dollar retain its reserve currency

demand is that the other currencies have been inflated, too. For example, Japan

has inflated the yen to a greater extent than the dollar in its foolish attempt

to revive its stagnant economy by cheapening its currency. The monetary

destruction disease is by no means limited to the United States.

The dollar is very

susceptible to losing its vaunted reserve currency position by the first major

trading country that stops inflating its currency. There is evidence China

understands what is at stake; it has increased its gold holdings and has

instituted controls to prevent gold from leaving China.

Should the world’s

second-largest economy and one of the world’s greatest trading nations tie its

currency to gold, demand for the yuan would increase and demand for the dollar

would decrease. In practical terms this means the world’s great trading nations

would reduce their holdings of dollars, and dollars held overseas would flow

back into the U.S. economy, causing prices to rise. How much would they rise?

It is hard to say, but keep in mind that there is an equal number of dollars

held outside the United States as there are inside the nation.

Yellen’s Dangerous QE

Fixation

President Obama’s imminent

appointment of career bureaucrat Janice Yellen as Chairman of the Federal

Reserve Board is evidence the U.S. policy of continuing to cheapen the dollar

via Quantitative Easing will continue. Her appointment increases the likelihood

that the demand for dollars will decline even further, raising the prospect of

much higher prices in the United States as demand by trading nations to hold

other currencies as reserves for trade settlement increases.

Perhaps only such

non-coercive pressure from a sovereign country like China can wake up the Fed

to the consequences of its actions and force it to end its Quantitative Easing

policy.

Patrick Barron

Patrick

Barron is president of PMG Consulting, LLC and has been a consultant to the

banking... (read full bio)

"http://news.heartland.org/newspaper-article/2013/10/14/how-much-longer-will-dollar-be-worlds-reserve-currency"

The

real savings from inflation for most Americans was in the value of their homes. Let’s say a home purchased in 1950 for

$10,000. Dollars and sold in 1970 for $25,000. Dollars gave its owner a healthy

$15,000. Dollars of profit. That’s good

inflation, right! Let’s now say that

that a home was purchased in 1990 for $80,000. Dollars. Because of the

collapse in home prices during 2007 this home owner sees his home equity drop

and instead of making money with the house, the loan on the home is now more

than the home is worth. Estimates for this home devaluation range between 20% to upwards of 50%. This is real bad

news. The same rate of inflation caused

two different outcomes based on the wave produced by the rise and fall of

inflation.

Now that we have written about the general features of inflation

we now need to cover another event which affects the US Dollar. They are loosely referred to as petrodollars. Because the US dollar is

the biggest buyers of the world’s oil, the dollar becomes pegged to world oil

prices. Also; many of the worlds oil producing nations prefer to be paid in US Dollars. In essence; the world is in

agreement with the concept of oil being more valuable than gold. President Nixon in 1971 removed our US

currency from the gold standard for many reasons.

Here is a Wikipedia article explaining the

history of this event along with a brief article describing “Petrodollars”. Understanding this event is probably the most important information of this article! Once we have a clear understanding of the foundation for which the United States Dollar is based upon then we are able to asses our currency a little better. It would seem dollars are based upon this simple formula: US GDP + World Oil Prices = Price of US Dollars and this is divided by the total number of Dollars in circulation!

Nixon Shock

From Wikipedia, the free encyclopedia

The Nixon

Shock was a series of economic measures taken by United

States President Richard

Nixon in 1971

including unilaterally canceling the direct convertibility of the United States dollar to gold. It helped end

the existing Bretton Woods system of international financial exchange,

ushering in the era of freely floating currencies that remains to the present

day.

Background

In 1944, the

Bretton Woods system fixed exchange rates based on the U.S. dollar, which was

redeemable for gold by the U. S. government at the price of $35 per ounce. Thus,

the United States was committed to backing every dollar overseas with gold.

Other currencies were fixed to the dollar, and the dollar was pegged to gold.

For the first

years after World War II, the Bretton Woods system worked well. With the Marshall

Plan Japan and

Europe were rebuilding from the war, and foreigners wanted dollars to spend on

American goods - cars, steel, machinery, etc. Because the U.S. owned over half

the world's official gold reserves - 574 million ounces at the end of World War

II - the system appeared secure.

However, from

1950 to 1969, as Germany and Japan recovered, the US share of the world's

economic output dropped significantly, from 35 percent to 27 percent.

Furthermore, a negative balance of payments, growing public

debt incurred by

the Vietnam

War and Great

Society programs, and monetary inflation by the Federal Reserve caused the

dollar to become increasingly overvalued in the 1960s. The drain on

US gold reserves culminated with the London

Gold Pool collapse in

March 1968.

By 1971,

America's gold stock had fallen to $10 billion, half its 1960 level. Foreign

banks held many more dollars than the U.S. held gold, leaving the U.S.

vulnerable to a run on its gold.

By 1971, the money

supply had increased

by 10%. In May 1971, West

Germany was the first

to leave the Bretton Woods system, unwilling to devalue the Deutsche

Mark in order to

prop up the dollar. In the

following three months, this move strengthened its economy. Simultaneously, the

dollar dropped 7.5% against the Deutsche Mark. Other nations

began to demand redemption of their dollars for gold. Switzerland redeemed $50

million in July. France

acquired $191 million in gold. On August 5,

1971, the United States

Congress released a

report recommending devaluation of the dollar,

in an effort to protect the dollar against "foreign price-gougers". On August 9,

1971, as the dollar dropped in value against European currencies, Switzerland

left the Bretton Woods system. The pressure

began to intensify on the United States to leave Bretton Woods.

Petrodollar

From Wikipedia, the free encyclopedia

A petrodollar

is a United States dollar earned by a country through the sale

of its petroleum (oil) to

another country. The term was

coined in 1973 by Georgetown University economics professor, Ibrahim

Oweiss, who

recognized the need for a term that could describe the dollar received by

petroleum exporting countries (OPEC) in exchange

for oil.

The term petrodollar

should not be confused with petrocurrency which refers

to the actual national currency of each petroleum exporting country.

In addition to

the United States petrodollar, a petrodollar can also refer to the Canadian

dollar in

transactions that involve the sale of Canadian oil to other

nations.

Large inflow of

petrodollar in a country often has an impact on the value of its currency. For

Canada it was shown that an increase of 10% in the price of oil increases the

Canadian dollar value versus the US dollar by 3% and vice

versa.

"wikipedia.com"

Now we turn our attention to the $TRILLION DOLLAR DEFICIT$. Many

of us may wonder why the government should print more money to pay off the

federal deficit? This could be

especially dangerous for economy! More

dollars flooding the world economy could make our currency worthless! Many of the world’s industrialized nations

prefer to be worth less than the US dollar, or another way to say this, is be

under or pegged to US Dollars. In today’s

world however; China is a new and economically powerful player and the US is not

able to predict what the Chinese will do in such an event. If the United States suddenly prints more money to deal with the deficit it could spark a world wide crises more devastating than the housing collapse of 2007-2012. A world wide depression could result.

Lets turn our attention now to what we could expect in the Fed printed more Dollars to pay down the deficit. A weaker Dollar - a Dollar worth less than the value of the currencies for the worlds other industrial nations could signal the begging for more and newer industry in the United States. More jobs. We've just painted a scenario which probably could never happen because no matter what, the other industrialized nations will always keep their currencies under the value of the US Dollar. Interesting stuff to think about!

This article is only meant to be an introduction to the subject of inflation and how it affects our economy. People devote their full attention to this subject in their duties for so many professions pertaining to and with economics. We have really only scratched the surface. As we close out this weeks article we are posting this article from "BloombergBussinessweek". This has been Felicity writing for the "Noodleman Group"!

“BloombergBussinessweek”

Volcker,

Greenspan, and Bernanke Unite for Fed's 100th Birthday

By Peter Coy December 17, 2013

Fed

Chairman Bernanke (center right) stands with former chairmen Greenspan (center

left) and Volcker (left) after a ceremony in Washington marking the centennial

of the founding of the Federal Reserve.

(Photograph by Nicholas Kamm/AFP

via Getty Images)

There were no balloons or party hats but if you’re a Fed

watcher, there was no bigger deal this week than the ceremony on Monday marking

the centennial of the Federal Reserve. The audience of roughly 80 people in the

Fed’s boardroom on Constitution Avenue in Washington was the biggest gathering

of current and former senior Fed officials in the bank’s history, according to

the master of ceremonies, Richmond Fed President Jeffrey Lacker.

The most interesting part of the afternoon ceremony, which has

been posted onYouTube (GOOG), was

what former Fed chairmen Paul Volcker (1979-1987) and Alan Greenspan

(1987-2006) and current Chairman Ben Bernanke (2006-present) had to say about

each other. Their comments were both respectful and revealing.

In 2008 Volcker had seemed to take a shot at Bernanke in a speech about

the Fed’s $29 billion emergency loan that year that paved the way for JPMorgan Chase’s(JPM) takeover of Bear Stearns.

“The Federal Reserve has judged it necessary to take actions that extend to the

very edge of its lawful and implied powers, transcending in the process certain

long-embedded central banking principles and practices,” Volcker said in a

speech to the Economic Club of New York.

Volcker, 86, made no mention of that episode on Monday, but he

seemed to toss a garland in Bernanke’s direction when he once again mentioned “strong

actions, sometimes testing the limits of its legal authority,” but this time

added that those actions by the Fed “rested on a sense of integrity—integrity

it’s achieved and maintained over the years in the sense that it was able to

act free of partisan political passions.”

Alan Greenspan, 87, making scant reference to his predecessor or

successor, focused his brief remarks on the biggest one-day collapse in stock

prices in U.S. history on Oct. 19, 1987, shortly after he took office. He said

“the days that followed that crash were truly frightening.” Interestingly,

Greenspan said that the crash itself, in which the Dow Jones industrial average

fell nearly 23 percent, “is a distant memory of no ongoing interest.” It

remains of intense interest to scholars of financial-market instability, who

fault Greenspan for putting too much faith in the self-stabilizing properties

of markets.

Bernanke, a spritely 60 in his last year on the job, spoke after

his elders, referring to them familiarly as “Paul” and “Alan.” He said he keeps

in his office a two-by-four length of wood that was mailed to Volcker as part

of a protest by builders against his tight-money inflation-fighting policies,

which depressed housing demand. He said the wood “communicates some distinctly

unfavorable views of high interest rates and their effects.” Of course, with

the federal funds rate at 0 to 0.25 percent, Bernanke is more often criticized

for keeping rates too low, not too high.

STORY: The Volcker Rule Is

Tough. It's Complicated. Will It Be Effective?

Under Bernanke’s predecessors. severe financial crises had faded

from sight. As Greenspan noted, the 1987 crash had no lasting effects. The Fed

perceived its main job as setting interest rates correctly. Bernanke observed,

though, that the Fed was born in response to the Panic of 1907. Without

mentioning Volcker or Greenspan, Bernanke said, “In response to the Panic of

2008, the Federal Reserve has returned to its roots by restoring financial

stability as a central objective alongside the traditional goals of monetary

policy.”

The birthday party was a few days early because it wasn’t until

Dec. 23, 1913, that President Woodrow Wilson signed the Federal Reserve Act.

Presumably the Fed didn’t want to wait until nearly Christmas Eve to celebrate.

“BloombergBussinessweek”

http://www.truthdig.com/cartoon/item/inflation_20130204

Tell your friends and associates about us!

It's easy! Just copy and paste me into your email!

* “The Noodleman Group” is pleased to announce that we are now carrying a link to the “USA Today” news site.We installed the “widget/gadget” August 20, and it will be carried as a regular feature on our site.Now you can read“Noodleman” and then check in to “USA Today” for all the up to date News, Weather, Sports and more!Just scroll all the way down to the bottom of our site and hit the “USA Today” hyperlinks.Enjoy!