http://themoneyupdate.com/the-global-economy-has-many-factors-working-against-it-in-the-upcoming-year/

* Special thanks to "Google Images", Wikipedia, "BBC News", "New Jersey.com"

and "USA Today".

* Special thanks to "Google Images", Wikipedia, "BBC News", "New Jersey.com"

and "USA Today".

BLOG POST

by Felicity Blaze Noodleman

Los Angeles, CA

11.29.14

Los Angeles, CA

11.29.14

Once again we are Noodeling the problems of modern day America. We are using the Internet to answer many questions and give us some direction as we all seem to be going down with the ship. This week we are picking up with a point which came out of last weeks article concerning Nuclear energy and electrical generating as a national natural resource. This week we want to examine how we as a nation could optimize job growth in the United States by modernizing and expanding both the production of more electricity and also rethinking how this resource is sold or distributed to compete with our competitors in the global market place.

As in last weeks article we wrote how Nuclear Energy seems to be coming to a conclusion as a generating source. This realization brings us back to some earlier methods of electrical generation along with some newer technologies to meet the demand for electricity.

Touching on the idea of electrical energy as a natural resource which is able to spur a nation’s economic growth we begin to see the need for a production capacity which is able to produce electricity in such vast quantities that the cost to all users both industrial and individual house hold is significantly less than today's rates. This concept is simple; in fact it is the simple law of supply and demand. If we as a nation could make this concept work, (with the governments assistance) all kinds of things would begin clicking in favor of the American people.

By comparing the US and China we discovered how China has lurched ahead of the world’s other industrialized nations by providing cheap electricity from its newly constructed Three Gorges Dam on the Yangtze river (a dam which makes Hoover Dam look like a mud puddle). Combined with other incentives China has been able to lure many of the world’s leading industries to open manufacturing facilities in the once heavily communistic country.

As in last weeks article we wrote how Nuclear Energy seems to be coming to a conclusion as a generating source. This realization brings us back to some earlier methods of electrical generation along with some newer technologies to meet the demand for electricity.

Touching on the idea of electrical energy as a natural resource which is able to spur a nation’s economic growth we begin to see the need for a production capacity which is able to produce electricity in such vast quantities that the cost to all users both industrial and individual house hold is significantly less than today's rates. This concept is simple; in fact it is the simple law of supply and demand. If we as a nation could make this concept work, (with the governments assistance) all kinds of things would begin clicking in favor of the American people.

By comparing the US and China we discovered how China has lurched ahead of the world’s other industrialized nations by providing cheap electricity from its newly constructed Three Gorges Dam on the Yangtze river (a dam which makes Hoover Dam look like a mud puddle). Combined with other incentives China has been able to lure many of the world’s leading industries to open manufacturing facilities in the once heavily communistic country.

It would seem that China has “raised the bar” and rewritten the book on capitalism and now the rest of the world’s leading nations must find a way to compete with the Chinese business model. While the US government for example, wants to Tax, Tax, and Tax industry and burden companies with all kinds of restrictions and regulations at every turn; the Chinese have found a way to subsidize Industry and work hand in hand with their new world corporations and, Jobs for the Chinese. The result for Americans is fewer and fewer jobs.

World currencies pivit on the values of their GNP (gross national product) Oil and Gold to set their values which is determined by the World Bank.

http://www.britannica.com/blogs/2008/11/nobel-economists-offer-first-aid-for-global-economy/

http://www.britannica.com/blogs/2008/11/nobel-economists-offer-first-aid-for-global-economy/

Google is literally littered with all kinds of news articles from the past warning of the United States current situation. In short to cut to the chase we must ask, why has not the Government done anything to keep up and compete in the new worlds economy and in particular, the Chinese to stop the flow of American jobs leaving this country?

Because the Democrats have allowed the mass exodus to happen as they have held the door open encouraging American Corporations to move out of the country. We say this because the Democrats have been in control of Washington for the majority of the past 60 years and because the destructive forces have come about through legislation sponsored and passed by the Democrats. Clearly the Democrats have gone rogue and forgotten the voters who put them in office. They are to busy with to many small trifling issues and the world scene and not attending to business here at home!

Because the Democrats have allowed the mass exodus to happen as they have held the door open encouraging American Corporations to move out of the country. We say this because the Democrats have been in control of Washington for the majority of the past 60 years and because the destructive forces have come about through legislation sponsored and passed by the Democrats. Clearly the Democrats have gone rogue and forgotten the voters who put them in office. They are to busy with to many small trifling issues and the world scene and not attending to business here at home!

Another disaster which has hurt the country and many Americans directly has been the recent collapse of the housing markets and added Trillions to the Federal deficit not to mention the biggest federal bailout economic mess in history. All of the catastrophes have been caused by the Democrats and their destructive policies. How much longer must we endure the disasters of this short sighted political party (and believe me this is stating the situation politely).

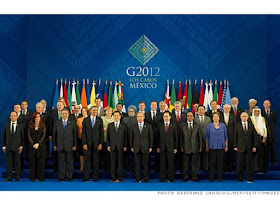

Group of 20 leaders met in Mexico as the global economy sputters and Europe struggles to stabilize its common currency. The Group of Twenty Finance Ministers and Central Bank Governors (also known as the G-20, G20, and Group of Twenty) is a group of finance ministers and central bank governors from 20 major economies: 19 countries plus the European Union, which is represented by the President of the European Council and by the European Central Bank. The G-20 heads of government or heads of state have also periodically conferred at summits since their initial meeting in 2008. Collectively, the G-20 economies account for approximately 80 percent of the gross world product (GWP), 80 percent of world trade (including EU intra-trade), and two-thirds of the world population. They furthermore account for 84.1 percent and 82.2 percent of the world's economic growth by nominal GDP and GDP (PPP) respectively from the years 2010 to 2016, according to the International Monetary Fund (IMF).

Wikipedia and http://money.cnn.com/2012/06/19/investing/g20/index.htm

This cartoon comments on the US economic collapse, but unfortunately as US economic experts have warned - they are not sure where the bottom is and that's because of the fluctuation in the world economy.

http://www.thelibertyvoice.com/30-reasons-to-get-nervous-about-the-u-s-economy

http://www.thelibertyvoice.com/30-reasons-to-get-nervous-about-the-u-s-economy

The two articles below begin to give us some insight concerning the complexities with both US economics and how it is effectuated by the new world economy:

“BBC News”

12 June 2013 Last updated at 22:36 ET

World Bank Cuts China Growth Forecast

There have been concerns whether China can sustain its high growth rate amid a global slowdown

The World Bank has cut its growth forecast for China amid warnings of slower but more stable global growth over the coming months.

The World Bank has cut its growth forecast for China amid warnings of slower but more stable global growth over the coming months.

The bank now expects the China to grow 7.7% in 2013, down from its earlier projection of 8.4%.

It also cut the forecast for global economic growth to 2.2% from 2.4%.

The bank said growth in China, the world's second-largest economy, had slowed as policymakers look to rebalance its growth model.

Over the past few decades China has relied heavily on exports and government-led investment to boost its economy.

However, a slowdown in key markets such as the US and Europe has seen a decline in demand for Chinese exports, prompting concerns whether China can sustain its high growth rate.

There have been calls for China to take measures to boost domestic demand to offset the decline in exports and rebalance its economy.

While Beijing has been keen to boost domestic consumption, analysts have said that the shift in its growth model may see China's growth rate slow in the short-term.

'Main risk'

The World Bank's cut to China's outlook comes just six months after it raised its forecast for the

While there are markers of hope in the financial sector, the slowdown in the real economy is turning out to be unusually protracted,”

In a report released in December last year, the bank said that stimulus measures and approval of infrastructure projects would help boost China's growth, and raised it forecast for 2013 to 8.4% from 8.1%

That was after Beijing had approved infrastructure projects worth more than $150bn (£94bn).

However, in its latest report, the bank raised concerns over China's investment-led growth model.

"The main risk related to China remains the possibility that high investment rates prove unsustainable, provoking a disorderly unwinding and sharp economic slowdown," it warned.

It further added that "should investments prove unprofitable, the servicing of existing loans could become problematic - potentially sparking a sharp uptick in non-performing loans that could require state intervention".

'Unusually protracted'

Globally, the World Bank said growth remained subdued in high income countries, especially in Europe, despite improvements in financial conditions.

It added that growth in emerging economies such as Brazil and India, which have seen robust growth rates in the past few years, have slowed more recently.

It said any pick-up in growth of developing countries was likely to "modest".

"While there are markers of hope in the financial sector, the slowdown in the real economy is turning out to be unusually protracted," said KaushikBasu, chief economist at the World Bank.

"This is reflected in the stubbornly high unemployment in industrialised nations, with unemployment in the eurozone actually rising, and in the slowing growth in emerging economies."

“BBC News”

“New Jersey.com”

U.S. Slipping in The Ranks of Global Competitive Economies, According to Survey Report

Published: Thursday, September 09, 2010, 9:10 PM

Updated: Thursday, September 09, 2010, 9:20 PM

By The Associated Press

BEIJING — The U.S. has slipped down the ranks of competitive economies, falling behind Sweden and Singapore due to huge deficits and pessimism about government, a global economic group said Thursday.

BEIJING — The U.S. has slipped down the ranks of competitive economies, falling behind Sweden and Singapore due to huge deficits and pessimism about government, a global economic group said Thursday.

Switzerland retained the top spot for the second year in the annual ranking by the Geneva-based World Economic Forum. It combines economic data and a survey of more than 13,500 business executives.

Sweden moved up to second place while Singapore stayed at No. 3. The United States was in second place last year after falling from No. 1 in 2008.

The WEF praised the United States for its innovative companies, excellent universities and flexible labor market. But it also cited huge deficits, rising government debt and declining public faith in politicians and corporate ethics.

"There has been a weakening of the United States' public and private institutions, as well as lingering concerns about the state of its financial markets," the group said.

Mapping a clear strategy for exiting the huge U.S. stimulus "will be an important step in reinforcing the country's competitiveness," it said.

The report was released in Beijing ahead of a WEF-organized gathering of global business executives next week in neighboring Tianjin. The group is best known for its annual Davos meeting of corporate leaders.

The report ranks 139 countries by assessing business efficiency, innovation, financial markets, health, education, institutions, infrastructure and other factors.

The United States was followed by Germany, Japan, Finland, the Netherlands, Denmark and Canada.

Switzerland held its top rank due to its strong innovation, evenhanded regulation and one of the world's most stable economic environments.

The WEF cited education and regulation as key areas for improvement in a number of economies and warned leaders not to lose sight of long-term needs as they struggle with the global crisis.

"For economies to remain competitive, they must ensure that they have in place those factors driving the productivity enhancements on which their present and future prosperity is built," one of the report's co-authors, Columbia University economist Xavier Sala-i-Martin, said in a statement.

China performed best among major developing economies, rising two places from last year to 27th based on its large and growing market, economic stability and increasing sophistication of its businesses.

Japan gained two places, helped by strong innovative abilities, though its status was hurt by the country's two-decade-old financial malaise.

Greece plunged 12 places to 83rd, plagued by a debt crisis and mounting public concern about corruption and government inefficiency, according to the WEF.

“New Jersey.com”

We've all heard about tax cuts, and how the stimulus money was spent, but did any one in Washing think about modernising the US infrastructure as a means for stimulating employment growth? More and cheaper electricity for example? What other areas could encourage and attract Corporations to relocate and stay in the US?http://www.nj.com/hudson/voices/index.ssf/2010/09/us_slipping_in_the_ranks_of_gl.html

Once again we have been thinking outside the box - way out side the box! It may sound like we are advocating the nationalization of energy and especially the generation of electricity in the United States but when we stop to remember that the Hoover Dam, The Tennessee Valley Authority and many of the Nuclear power generating stations were all Government projects to begin with the idea begins to become clearer. What we are doing is putting a finer point on the concept and using it to create more jobs by offering companies an incentive build their products in the USA.

Wikipedia - Wilson Dam, completed in 1924, was the first dam under the authority of TVA, created in 1933. Many of the Hydro Electrical producing dams in the United States are nearing their 100 year anniversary and the country is in need of many upgrades to the electrical infrastructure.

This has been Felicity with the "Noodleman Group" again!

http://www.theguardian.com/business/2011/may/01/west-declining-developing-world-40-year-boom

Tell your friends and associates about us!

It's easy! Just copy and paste me into your email!

* “The Noodleman Group” is pleased to announce that we are now carrying a link to the “USA Today” news site.We installed the “widget/gadget” August 20, and it will be carried as a regular feature on our site.Now you can read“Noodleman” and then check in to “USA Today” for all the up to date News, Weather, Sports and more!Just scroll all the way down to the bottom of our site and hit the “USA Today” hyperlinks.Enjoy!

No comments:

Post a Comment